Bankrate's refinance breakeven calculator can help you figure out this timeline. If you're not planning to stay in your current home for more than a few years, the savings you get from a lower rate might not outweigh those costs before you move. A refi usually comes with upfront costs at the closing, just like an initial mortgage, and those can add up. One of the most important factors in refinancing is figuring out your break-even timeline. You can improve your credit score by reducing your credit utilization ratio (the proportion of credit you’re using compared to your credit limit) and paying down your highest-interest or highest-payment debt. Typically, mortgage lenders want to see a credit score of 620 or better for a refinance, but there are some refinance options if you have poor credit, including streamline programs. If you're not happy with your credit score or the rates you're being quoted, work on boosting your credit first, then try to refinance again once you've improved it. Check your credit scoreĪ better credit score will help you secure a better rate and make your refinance even more cost-effective. If you can get an adequately lower rate, refinancing can save you a substantial amount in interest charges, but it does require some work: 1.

#ONLINE MORTGAGE QUOTE CALCULATOR HOW TO#

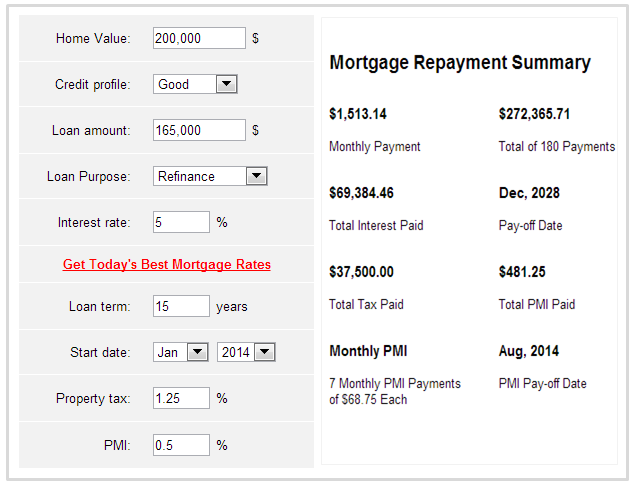

How to refinance your mortgage in 5 steps As you weigh offers, be sure to consider APRs, lender fees and closing costs to ensure you’re making accurate comparisons - and maximizing your savings potential. Our rate table filters allow you to plug in general information about your finances and location to receive tailored offers. Compare mortgage offers online: Bankrate helps you easily compare mortgage offers by using our mortgage rate table below.

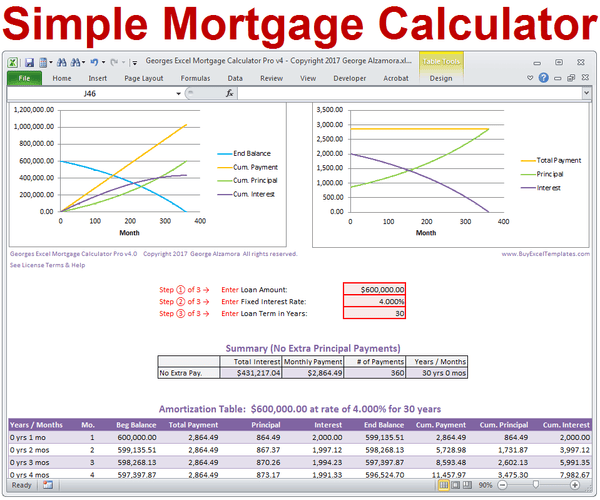

How much you regularly spend – on things like your credit or store cards, loans, overdrafts, maintenance and pension.When you apply for a mortgage or use our calculator, we’ll ask you for information like What information do I need to use a calculator and how do you decide what I can afford? It’s for you if you’re a first time buyer, you’re looking to remortgage, move or buy an additional home, or you’re a buy-to-let landlord. We have different calculators that can help you in different ways – each calculator does something slightly different. It’s a tool that gives you an estimate of how much you could borrow from us or what your monthly repayments and other costs might be, for a mortgage in the UK.

0 kommentar(er)

0 kommentar(er)